Financial History Of The Dutch Republic on:

[Wikipedia]

[Google]

[Amazon]

The financial history of the Dutch Republic involves the interrelated development of financial institutions in the

The financial history of the Dutch Republic involves the interrelated development of financial institutions in the

The most important source of revenue, collectively known as ''gemene middelen'' (common means), were a set of

The most important source of revenue, collectively known as ''gemene middelen'' (common means), were a set of

Provincial and municipal borrowers in these days issued three types of debt instrument:

*

Provincial and municipal borrowers in these days issued three types of debt instrument:

*

Dutch involvement with loans to foreign governments had been as old as the Republic. At first such loans were provided by banking houses (as was usual in early-modern Europe), with the guarantee of the States General, and often also subsidized by the Dutch government. An example is the loan of 400,000 Reichstalers to

Dutch involvement with loans to foreign governments had been as old as the Republic. At first such loans were provided by banking houses (as was usual in early-modern Europe), with the guarantee of the States General, and often also subsidized by the Dutch government. An example is the loan of 400,000 Reichstalers to

Instead, in 1609 a new municipal institution was established (after the example of the Venetian '' Banco della Piassa di Rialto'', established in 1587) in the form of the

Instead, in 1609 a new municipal institution was established (after the example of the Venetian '' Banco della Piassa di Rialto'', established in 1587) in the form of the

Mercantile trade brought risks of shipwreck and piracy. Such risks were often self-insured. The East-India Company armed its vessels, and maintained extensive military establishments abroad, thereby internalizing protection costs. Arming merchantmen was quite usual in those days. However, the type of cargo vessel most often used by the Dutch, the

Mercantile trade brought risks of shipwreck and piracy. Such risks were often self-insured. The East-India Company armed its vessels, and maintained extensive military establishments abroad, thereby internalizing protection costs. Arming merchantmen was quite usual in those days. However, the type of cargo vessel most often used by the Dutch, the

Other examples of self-insurance were the partnerships of ship owners, known as ''partenrederijen'' (which is probably best translated as "managed partnership", although these were precursors of

Trading in financial instruments, let alone speculation, was not limited to the stock exchange, however. Notorious is the speculative bubble in tulip futures, known as the 1637

Trading in financial instruments, let alone speculation, was not limited to the stock exchange, however. Notorious is the speculative bubble in tulip futures, known as the 1637

''Het Groote Tafereel der Dwaasheid''''English Translation: The Great Mirror of Folly''

. The great import of this episode is that it shows that by this time the capital market had become truly international, not only for long-term bonds, but now also for short-term capital. Financial crises easily propagated because of this. Examples are the crisis of 1763, after the end of the

The

The

Het Groote Tafereel Der Dwaasheid - One of over 2,000 finance books in the IFA LibraryJ.G. van Dillen ''et al.'', Isaac Le Maire and the early trading in Dutch East India Company sharesMeir Kohn, Business organization in Pre-Industrial EuropeLarry Neal, Venture shares of the Dutch East India Company

{{DEFAULTSORT:Financial History Of The Dutch Republic Economic history of the Dutch Republic Economies by former country Financial history by country Dutch Republic

The financial history of the Dutch Republic involves the interrelated development of financial institutions in the

The financial history of the Dutch Republic involves the interrelated development of financial institutions in the Dutch Republic

The United Provinces of the Netherlands, also known as the (Seven) United Provinces, officially as the Republic of the Seven United Netherlands (Dutch: ''Republiek der Zeven Verenigde Nederlanden''), and commonly referred to in historiography ...

. The rapid economic development of the country after the Dutch Revolt

The Eighty Years' War or Dutch Revolt ( nl, Nederlandse Opstand) (Historiography of the Eighty Years' War#Name and periodisation, c.1566/1568–1648) was an armed conflict in the Habsburg Netherlands between disparate groups of rebels and t ...

in the years 1585 - 1620 accompanied by an equally rapid accumulation of a large fund of savings, created the need to invest those savings profitably. The Dutch financial sector, both in its public and private components, came to provide a wide range of modern investment products beside the possibility of (re-)investment in trade and industry, and in infrastructure projects. Such products were the public bonds, floated by the Dutch governments on a national, provincial, and municipal level; acceptance credit and commission trade; marine and other insurance products; and shares of publicly traded companies like the Dutch East India Company

The United East India Company ( nl, Verenigde Oostindische Compagnie, the VOC) was a chartered company established on the 20th March 1602 by the States General of the Netherlands amalgamating existing companies into the first joint-stock ...

(VOC), and their derivatives. Institutions like the Amsterdam stock exchange

Euronext Amsterdam is a stock exchange based in Amsterdam, the Netherlands. Formerly known as the Amsterdam Stock Exchange, it merged on 22 September 2000 with the Brussels Stock Exchange and the Paris Stock Exchange to form Euronext. The r ...

, the Bank of Amsterdam

The Bank of Amsterdam ( nl, Amsterdamsche Wisselbank, lit=Exchange Bank of Amsterdam) was an early bank, vouched for by the city of Amsterdam, and established in 1609. It was the first public bank to offer accounts not directly convertible to co ...

, and the merchant bankers helped to mediate this investment. In the course of time the invested capital stock generated its own income stream that (because of the high propensity to save of the Dutch capitalists) caused the capital stock to assume enormous proportions. As by the end of the 17th century structural problems in the Dutch economy precluded profitable investment of this capital in domestic Dutch sectors, the stream of investments was redirected more and more to investment abroad, both in sovereign debt and foreign stocks, bonds and infrastructure. The Netherlands came to dominate the international capital market up to the crises of the end of the 18th century that caused the demise of the Dutch Republic.

Introduction

To fully understand the peculiarities of the history of the system of public finance, and that of the closely related system of private (international) finance and banking of the Dutch Republic, one has to view it in the context of the generalhistory of the Netherlands

The history of the Netherlands is a history of seafaring people thriving in the lowland river delta on the North Sea in northwestern Europe. Records begin with the four centuries during which the region formed a militarized border zone of the Ro ...

and of its institutions, and of the general Economic History of the Netherlands (1500 - 1815)

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with the ...

. In contrast to that general history this is a ''sectoral'' history, concerning the fiscal and financial sector.

It is important to realize that those general histories differ in an important way from those of centralized Western European monarchies, like Spain

, image_flag = Bandera de España.svg

, image_coat = Escudo de España (mazonado).svg

, national_motto = ''Plus ultra'' (Latin)(English: "Further Beyond")

, national_anthem = (English: "Royal March")

, i ...

, France

France (), officially the French Republic ( ), is a country primarily located in Western Europe. It also comprises of Overseas France, overseas regions and territories in the Americas and the Atlantic Ocean, Atlantic, Pacific Ocean, Pac ...

, England

England is a country that is part of the United Kingdom. It shares land borders with Wales to its west and Scotland to its north. The Irish Sea lies northwest and the Celtic Sea to the southwest. It is separated from continental Europe b ...

, Denmark

)

, song = ( en, "King Christian stood by the lofty mast")

, song_type = National and royal anthem

, image_map = EU-Denmark.svg

, map_caption =

, subdivision_type = Sovereign state

, subdivision_name = Danish Realm, Kingdom of Denmark

...

and Sweden

Sweden, formally the Kingdom of Sweden,The United Nations Group of Experts on Geographical Names states that the country's formal name is the Kingdom of SwedenUNGEGN World Geographical Names, Sweden./ref> is a Nordic country located on ...

in the early modern era. The Netherlands were highly decentralized from their origins in the Habsburg Netherlands

Habsburg Netherlands was the Renaissance period fiefs in the Low Countries held by the Holy Roman Empire's House of Habsburg. The rule began in 1482, when the last House of Valois-Burgundy, Valois-Burgundy ruler of the Netherlands, Mary of Burgu ...

in the late 15th century, and (other than the monarchies just mentioned) successfully resisted attempts to bring them together under the centralized authority of a modern state. Indeed, the Dutch Revolt

The Eighty Years' War or Dutch Revolt ( nl, Nederlandse Opstand) (Historiography of the Eighty Years' War#Name and periodisation, c.1566/1568–1648) was an armed conflict in the Habsburg Netherlands between disparate groups of rebels and t ...

that gave rise to the Republic of the United Netherlands, effectively resulted from resistance against attempts by the representatives of king Philip II of Spain

Philip II) in Spain, while in Portugal and his Italian kingdoms he ruled as Philip I ( pt, Filipe I). (21 May 152713 September 1598), also known as Philip the Prudent ( es, Felipe el Prudente), was King of Spain from 1556, King of Portugal from ...

, the Habsburg ruler of the country, to institute such a centralized state and a centralized system of public finance. Where in other instances the modern fiscal system resulted from, and was made subservient to, the interests of a centralizing monarchical state, in the Dutch instance the emerging fiscal system was the basis of, and was mobilized in the interests of the defense of, a stubbornly decentralised political entity.

Ironically, the Habsburg rulers themselves pushed through the fiscal reforms that gave the rebellious provinces the wherewithal to resist the power of the sovereign. Emperor Charles V Charles V may refer to:

* Charles V, Holy Roman Emperor (1500–1558)

* Charles V of Naples (1661–1700), better known as Charles II of Spain

* Charles V of France (1338–1380), called the Wise

* Charles V, Duke of Lorraine (1643–1690)

* Infan ...

needed to increase the borrowing capacity of his government to finance his many military adventures. To that end it was necessary to put in place a number of fiscal reforms that would ensure that the public debt could be adequately serviced (thereby increasing the creditworthiness of his government). In 1542 the president of the Habsburg Council of State, Lodewijk van Schoor, proposed the levy of a number of taxes throughout the Habsburg Netherlands: a Tenth Penny (10 percent tax) on the income from real property and private loans, and excise taxes on beer, wine, and woollen cloth.De Vries and Van der Woude, p. 92 These permanent taxes, collected by the individual provinces, would enable the provinces to pay enlarged subsidies to the central government, and (by issuing bonds secured by the revenue of these taxes) finance extraordinary levies (''beden'' in old Dutch

Dutch commonly refers to:

* Something of, from, or related to the Netherlands

* Dutch people ()

* Dutch language ()

Dutch may also refer to:

Places

* Dutch, West Virginia, a community in the United States

* Pennsylvania Dutch Country

People E ...

) in time of war. Other than expected, these reforms strengthened the position of the provinces, especially Holland, because as a condition of agreeing to the reform the States of Holland The States of Holland and West Frisia ( nl, Staten van Holland en West-Friesland) were the representation of the two Estates (''standen'') to the court of the Count of Holland. After the United Provinces were formed — and there no longer was a c ...

demanded and got total control of the disbursement of the taxes.

Holland was now able to establish credit of its own, as the province was able to retire bond loans previously placed under compulsion as enforced loans. By this it demonstrated to potential creditors it was worthy of trust. This brought a market for voluntary credit into being that previously did not exist. This enabled Holland, and other provinces, to float bonds at a reasonable interest rate in a large pool of voluntary investors.

The central government did not enjoy this good credit. On the contrary, its financing needs increased tremendously after the accession of Philip II, and this led to the crisis that caused the Revolt. The new Regent Fernando Álvarez de Toledo, 3rd Duke of Alba

Fernando Álvarez de Toledo y Pimentel, 3rd Duke of Alba (29 October 150711 December 1582), known as the Grand Duke of Alba (, pt, Grão Duque de Alba) in Spain and Portugal and as the Iron Duke ( or shortly 'Alva') in the Netherlands, was a Sp ...

tried to institute new taxes to finance the cost of suppression of public disturbances after the Iconoclastic Fury

''Beeldenstorm'' () in Dutch and ''Bildersturm'' in German (roughly translatable from both languages as 'attack on the images or statues') are terms used for outbreaks of destruction of religious images that occurred in Europe in the 16th centu ...

of 1566 without going through proper constitutional channels. This brought about a general revolt in the Netherlands, particularly in the northern provinces. Those were able to withstand the onslaught of the royalist forces militarily, because of the fiscal basis they had built in previous years.

Of course, they now withheld the subsidies to the central government their taxes were supposed to finance. That central government was therefore forced to finance the war by transfers from other Habsburg lands, especially Spain itself. This led to an enormous increase in the size of the Spanish public debt, which that country was ultimately unable to sustain, and hence to the need to accept Dutch independence in 1648.

As explained in the general article on the economic history of the Netherlands, the political revolt soon engendered an economic revolution also, partly related to political events (like the rise of the Dutch East India Company

The United East India Company ( nl, Verenigde Oostindische Compagnie, the VOC) was a chartered company established on the 20th March 1602 by the States General of the Netherlands amalgamating existing companies into the first joint-stock ...

and its West-Indies colleague), in other respects unrelated (like the revolutions in shipping, fisheries, and industry, that seem to be more due to technological innovations). This economic revolution was partly the cause of, and partly helped along further, by a number of fiscal and financial innovations that helped the Dutch economy make the transition to "modernity" in the early 17th century.

Public Finance

The "constitution" of the new Republic, the Union-of-Utrecht treaty of 1579, tried to lay the basis of a revolutionary new fiscal system. It put in place a rudimentaryconfederal

A confederation (also known as a confederacy or league) is a union of sovereign groups or states united for purposes of common action. Usually created by a treaty, confederations of states tend to be established for dealing with critical issu ...

budget system that charged the ''Raad van State'' (Council of State) with drafting an annual ''Staat van Oorlog'' (war budget). This budget

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmenta ...

was presented in a "General Petition" to the States-General for (unanimous) approval.De Vries and Van der Woude, p. 96

The treaty next required that the tax revenues for the financing of this budget would be levied "...equally in all united provinces, and at the same rate.". Furthermore, it prohibited internal tariffs and other taxes discriminating against residents of other provinces. Alas, these two latter provisions were never implemented. Instead, the provinces continued the practice under the Habsburg rulers that the provinces paid a fixed quotum (the ''repartitie'') of the budget. Holland's contribution was the norm from which the contributions of other provinces were derived. After some changes the quota

Quota may refer to:

Economics

* Import quota, a trade restriction on the quantity of goods imported into a country

* Market Sharing Quota, an economic system used in Canadian agriculture

* Milk quota, a quota on milk production in Europe

* Indi ...

were fixed in 1616 as follows (to remain unchanged till 1792): Friesland

Friesland (, ; official fry, Fryslân ), historically and traditionally known as Frisia, is a province of the Netherlands located in the country's northern part. It is situated west of Groningen, northwest of Drenthe and Overijssel, north of ...

one-fifth of Holland's share; Zeeland

, nl, Ik worstel en kom boven("I struggle and emerge")

, anthem = "Zeeuws volkslied"("Zeelandic Anthem")

, image_map = Zeeland in the Netherlands.svg

, map_alt =

, m ...

(after some diligent bargaining) 16 percent; Utrecht

Utrecht ( , , ) is the List of cities in the Netherlands by province, fourth-largest city and a List of municipalities of the Netherlands, municipality of the Netherlands, capital and most populous city of the Provinces of the Netherlands, pro ...

and Groningen

Groningen (; gos, Grunn or ) is the capital city and main municipality of Groningen province in the Netherlands. The ''capital of the north'', Groningen is the largest place as well as the economic and cultural centre of the northern part of t ...

one-tenth each; Gelderland

Gelderland (), also known as Guelders () in English, is a province of the Netherlands, occupying the centre-east of the country. With a total area of of which is water, it is the largest province of the Netherlands by land area, and second by ...

9.6 percent; Overijssel

Overijssel (, ; nds, Oaveriessel ; german: Oberyssel) is a Provinces of the Netherlands, province of the Netherlands located in the eastern part of the country. The province's name translates to "across the IJssel", from the perspective of the ...

6.1 percent; and Drenthe

Drenthe () is a province of the Netherlands located in the northeastern part of the country. It is bordered by Overijssel to the south, Friesland to the west, Groningen to the north, and the German state of Lower Saxony to the east. As of Nov ...

(though not represented in the States-General) 1 percent.

The States-General had only two direct sources of income: it taxed the Generality Lands

The Generality Lands, Lands of the Generality or Common Lands ( nl, Generaliteitslanden) were about one fifth of the territories of the United Provinces of the Netherlands, that were directly governed by the States-General. Unlike the seven pr ...

directly, and the five Admiralties

The Admiralty Islands are an archipelago group of 18 islands in the Bismarck Archipelago, to the north of New Guinea in the South Pacific Ocean. These are also sometimes called the Manus Islands, after the largest island.

These rainforest-cov ...

set up under its authority, financed their activities nominally from the '' Convooien en Licenten'' levied on trade. Otherwise, the provinces determined themselves how they would collect the revenues to finance their ''repartitie''. Within the provinces there were other quota systems to determine the contributions of the cities and of the countryside. In Holland, the city of Amsterdam was by far the largest contributor (though this was different from Habsburg times, when Delft made the relatively largest contribution), which explained the influence that city wielded, even at the national level.

This system remained in place throughout the life of the Republic. Simon van Slingelandt

Simon van Slingelandt, lord of the manor of Patijnenburg (14 January 1664, in Dordrecht – 1 December 1736, in The Hague) was Grand Pensionary of Holland from 17 July 1727 to 1 December 1736.

Simon van Slingelandt was the son of Govert van Sling ...

made an attempt in 1716 to reform it by giving more power to the center. He convened the ''Groote Vergadering'' (a kind of constitutional convention) in that year, prompted by the fact that the Generality faced a liquidity crisis In financial economics, a liquidity crisis is an acute shortage of ''liquidity''. Liquidity may refer to market liquidity (the ease with which an asset can be converted into a liquid medium, e.g. cash), funding liquidity (the ease with which borrowe ...

in 1715, when most provinces fell into arrears on their contributions. However, this august body rejected all reform proposals, opting instead for "muddling through." Ten years later Van Slingelandt was made Grand Pensionary of Holland, but on condition that he not press for constitutional reforms.De Vries and Van der Woude, p. 122 Except for a reshuffling of the provincial quota in 1792, a real reform of the system had to wait till after the demise of the Republic. The public debt was consolidated on a national level in 1798, and the system of taxation only unified in 1806.

Taxation

AsHolland

Holland is a geographical regionG. Geerts & H. Heestermans, 1981, ''Groot Woordenboek der Nederlandse Taal. Deel I'', Van Dale Lexicografie, Utrecht, p 1105 and former province on the western coast of the Netherlands. From the 10th to the 16th c ...

was the most important province, usually paying 58 percent of the total budget, it is probably useful to concentrate the discussion on this province (also because other provinces modeled themselves on the Holland system). It based its fiscal structure on the system inherited from the Habsburg era, mentioned above, but extended it in important respects.

The most important source of revenue, collectively known as ''gemene middelen'' (common means), were a set of

The most important source of revenue, collectively known as ''gemene middelen'' (common means), were a set of excise tax

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when ...

es on first necessities, especially on beer, wine, peat, grain, salt, and the use of market scales. These were essentially transaction taxes, as they were levied at a fixed rate, not ''ad valorem

An ''ad valorem'' tax (Latin for "according to value") is a tax whose amount is based on the value of a transaction or of property. It is typically imposed at the time of a transaction, as in the case of a sales tax or value-added tax (VAT). An ...

'' (the revenue stamp

A revenue stamp, tax stamp, duty stamp or fiscal stamp is a (usually) adhesive label used to designate collected taxes or fees on documents, tobacco, alcoholic drinks, drugs and medicines, playing cards, hunting licenses, firearm registration, ...

s introduced later in the 17th century basically fall in the same category as they tax transactions in commerce). In the 1630s this type of tax accounted for two-thirds of Holland's revenue. It then amounted to about ten guilders per capita (while per capita income for most people may have been much lower than the average of about 150 guilders a year). These taxes were levied on the seller of the good, who presumably passed them on to the consumer. They were collected by tax farmers

Farming or tax-farming is a technique of financial management in which the management of a variable revenue stream is assigned by legal contract to a third party and the holder of the revenue stream receives fixed periodic rents from the contract ...

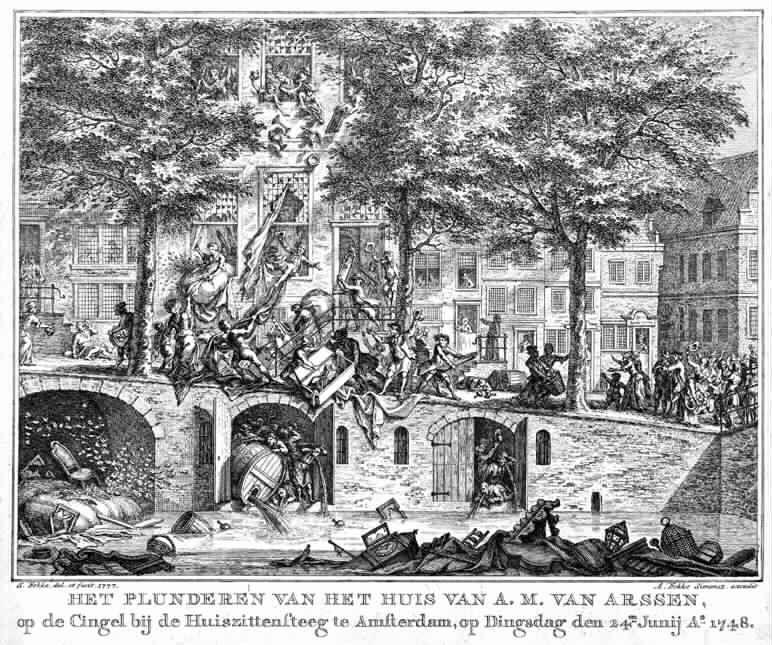

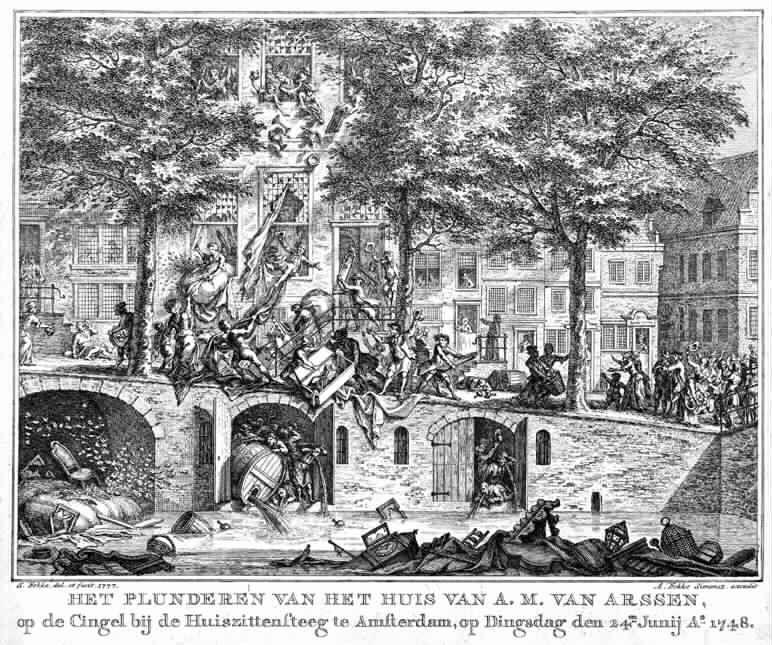

, who bought their farms at auction, at least until the Pachtersoproer

The pachtersoproer was a Dutch rebellion in the 18th century. The origin of the uprising was to be found in the economic malaise of the 1740s as a result of the Austrian War of Succession. It was the system of commercial tax-collection called ''pac ...

in 1748 put a stop to this practice. In Holland the real abuses of the system, though perceived to be great, may not have been as serious as the French abuses of the tax farms in that country. This was, because the tax farmers were numerous, low-status, and politically subordinate to the city Regenten

In the 16th, 17th and 18th centuries, the regenten (the Dutch plural for ''regent'') were the rulers of the Dutch Republic, the leaders of the Dutch cities or the heads of organisations (e.g. "regent of an orphanage"). Though not formally a heredi ...

, for which they formed a convenient barrier against popular discontent. Because of this weak position the Dutch tax farmers may have been less able than their French colleagues to exploit their privileges.

Though the excises were a heavy burden on the common man, at least in the first quarter of the 17th century, somewhat surprisingly this regressive taxation

A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. "Regressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from high ...

burden may have abated somewhat in later years. There were several factors for this. Many excises incorporated mitigating provisions, like exemptions and sliding scales, that reweighed their impact in the direction of higher-income people (like graduation of the beer tax according to quality; conversion of the grain and salt taxes to per-capita taxes on assumed consumption; a progressive tariff for the tax on household servants, and on weddings and burials, that may be seen as wealth taxes, as most people were exempt). Finally, the relative importance of these excises in total revenue declined in later years. It accounted for 83 percent of total revenue in 1650, but only 66 percent in 1790.

The types of tax that were next in importance were the real and personal property tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheri ...

es like the ''verponding'', a kind of rates

Rate or rates may refer to:

Finance

* Rates (tax), a type of taxation system in the United Kingdom used to fund local government

* Exchange rate, rate at which one currency will be exchanged for another

Mathematics and science

* Rate (mathema ...

. This amounted to 8.5 percent (the Twelfth Penny) of the rental value of all real property. This tax, first introduced in 1584, was based on assessments of land described in registers that were not updated. To remedy the problems resulting therefrom a new survey in 1632 resulted in new registers, and at this time the tax was fixed at 20 percent of land rents and 8.5 percent of house rental values, all levied on the landlords. Whether they passed these on was determined by economic conditions, of course.

Unfortunately, 1632 proved from hindsight to be a top year for property prices. As rents plunged after the middle of the century, the real burden of the ''verponding'' therefore increased sharply. Also, in the war years after 1672 extraordinary levies, up to three times a year, were often imposed, amounting to 100 percent of the normal ''verponding''. Pressure for new assessments was therefore high, but in 1732, after a century, the registers were only revised for house rents. The loss of revenue was otherwise deemed to be unacceptable. Farmers had to wait for the lifting of the agricultural depression after 1740 for relief through higher incomes.

Finally, direct tax

Although the actual definitions vary between jurisdictions, in general, a direct tax or income tax is a tax imposed upon a person or property as distinct from a tax imposed upon a transaction, which is described as an indirect tax. There is a dis ...

es on income and wealth were the third major pillar of the tax system in Holland. Due to the difficulty of assessing incomes, at first the emphasis was put here on taxes on capital, like the inheritance tax

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died, whereas an estate tax is a levy on the estate (money and property) of a person who has died.

International tax law distinguishes between an es ...

, and a number of forced loans that amounted to taxes. Income taxes were attempted in 1622, and again in 1715, but they proved impracticable. In 1742 Holland tried to impose the ''personeel quotisatie'' (whose registers offer a useful source to the social historian), which remained in force for eleven years, before it was abandoned. This was a progressive income tax

A progressive tax is a tax in which the tax rate increases as the taxable amount increases.Sommerfeld, Ray M., Silvia A. Madeo, Kenneth E. Anderson, Betty R. Jackson (1992), ''Concepts of Taxation'', Dryden Press: Fort Worth, TX The term ''progre ...

, levied on incomes over 600 guilders (the highest quintile) at a rate, ranging from 1.0 to 2.5 percent.

Wealth tax

A wealth tax (also called a capital tax or equity tax) is a tax on an entity's holdings of assets. This includes the total value of personal assets, including cash, bank deposits, real estate, assets in insurance and pension plans, ownershi ...

es proved to be more feasible. The Hundredth and the Thousandth Penny were regularly levied on real and personal property (as distinguished from the ''income'' from property, like the ''verponding'') from 1625. In the difficult years after 1672, when war required high ''repartities'', extraordinary wealth taxes were imposed very frequently, amounting to a total levy of (theoretically) 14 percent of all real property, seigneurial rights, tithes, bonds, and personal objects of value. In 1674 Holland put this ''ad hoc'' taxation on a regular footing by founding a new register (the ''personele kohier''). From then on the 100th and 200th penny could regularly be collected.

Finally, a curious predecessor of a tax like the dividend tax

A dividend tax is a tax imposed by a jurisdiction on dividends paid by a corporation to its shareholders (stockholders). The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the f ...

was the levying after 1722 of the 100th and 200th penny on the income from provincial bonds, which then replaced the general wealth tax just mentioned. This withholding tax

Tax withholding, also known as tax retention, Pay-as-You-Go, Pay-as-You-Earn, Tax deduction at source or a ''Prélèvement à la source'', is income tax paid to the government by the payer of the income rather than by the recipient of the income ...

proved to be very convenient, but had the unintended consequence that the effective yield of Holland bonds (other bonds were not taxed) was commensurately lowered. Holland therefore had to pay a higher rate on its bonds, which more or less defeated the purpose.

All these taxes imposed a considerable burden on the Dutch tax payer, compared to his contemporaries in neighboring countries. There were no exemptions for churchmen or aristocrats. The Republic had sufficient authority to have these burdens accepted by its citizens, but this was a function of the "bottom-up" implementation of the taxes. Municipal and provincial tax authorities possessed more legitimacy than central authorities, and this legitimacy was reinforced by the fact that the broad tax base enabled local authorities to tailor taxes to local circumstances. The taxation system thereby underpinned the federal structure of the Dutch state.

Other than for other provinces, a reasonably accurate picture can be sketched of developments in revenue and tax burden in the province of Holland. In the two decades of the Revolt after 1568, Holland's revenues exploded in a tenfold increase compared to pre-Revolt years, proving that Dutchmen were not opposed to paying taxes ''per se'' (despite the fact that they had started a revolution about Alva's taxes). The revenue kept growing after 1588, rising threefold in the period till 1630. However, the real per-capita tax burden remained constant in the years up to 1670. This reflected the tremendous economic growth in the Golden Age, on the one hand, and a rapid expansion of the tax base, commensurate with this growth, on the other hand.

As in the economy in general, there was a sharp break after 1672. Whereas the economy stagnated, expenditures in connection with the wars, and hence taxes too, rose. Taxes doubled by the 1690s, but nominal wages (as distinguished from real wages, which rose due to the general decline in price levels) remained constant. At the same time the tax base almost certainly shrank as a consequence of the economic decline. This resulted in a doubling of the per-capita tax burden. This development levelled off after the Peace of Utrecht

The Peace of Utrecht was a series of peace treaties signed by the belligerents in the War of the Spanish Succession, in the Dutch city of Utrecht between April 1713 and February 1715. The war involved three contenders for the vacant throne of ...

in 1713, when the Republic entered a period of peace and neutrality (though there was a spike when it was dragged into the War of the Austrian Succession

The War of the Austrian Succession () was a European conflict that took place between 1740 and 1748. Fought primarily in Central Europe, the Austrian Netherlands, Italy, the Atlantic and Mediterranean, related conflicts included King George's W ...

). However, it did not result in a reduction of the per-capita tax burden up to the final crisis of the Republic and its economy after 1780. Then that tax burden again sharply increased. Presumably, the other provinces globally followed these developments, though at a distance, because of their different economic circumstances.

Other than for Holland (for which more data are known) revenue figures for the Republic as a whole are available for 1716, when it amounted to 32.5 million guilders, and again for 1792 (when the ''repartitie''-system was revised for the first time), when it came to 40.5 million (inflated) guilders. After 1795 the Batavian Republic

The Batavian Republic ( nl, Bataafse Republiek; french: République Batave) was the successor state to the Republic of the Seven United Netherlands. It was proclaimed on 19 January 1795 and ended on 5 June 1806, with the accession of Louis Bona ...

collected regular revenue statistics. These figures allow the following observations: in 1790 the per-capita tax burden at the national level in the Republic was comparable to that in Great Britain, and twice that in France (which had just started a revolution about that tax burden). This reflected a rapid rise in tax burdens in both France and Great Britain during the 18th century in which both countries made up a large difference with the Republic (but also in income levels, of course). Extrapolating backward, the Dutch level of taxation in 1720 probably was double that of Britain. Dutch innovations like excises and stamp taxes were followed with a lag of a century in the larger countries.

The stagnation of the growth in the Dutch per-capita tax burden during the 18th century (while the Republic's rivals made up their arrears) may reflect both a lack of political will on the part of the authorities to exact higher burdens, and economic limits to taxation. The latter hypothesis is indirectly supported by the fact that after 1672 the tax system became far less regressive than before. Apparently, the common man was spared a further increase of his tax burden. Henceforth, "the rich" were burdened more severely by efforts at direct taxation, than during the Golden Age. However, this applied more to people rich in land and (provincial) bonds, than to people investing in commerce and ''foreign'' bonds. Source of income was therefore very important. This also contributed to the peculiar developments around the public debt in the 18th century.

Public Debt

Usually, taxation and borrowing are seen as alternative means of financing public expenditures, at least if they are available with equal ease. Borrowing is sometimes inevitable when a spike in expenditures would necessitate an unsupportable spike in taxation otherwise. This was the usual justification for taking on public debt in the days of the Habsburg Netherlands, when the province of Holland built up an enviable public credit. Alas, in the first years of the Revolt this credit evaporated and Holland (let alone the Republic) was forced to increase taxation very strongly (as we have seen), partly by resorting to forced loans (which at least offered the solace of paying interest and holding out the hope of ultimate redemption). Voluntary loans were only to be had from people related to government (like the Prince of Orange) and from the Office of Ecclesiastical Property, the institution that managed the expropriated real property of the Roman Catholic Church. That office was charged with continuing the charitable works of the Church foundations, which it could conveniently do by selling its choice properties and investing the proceeds in interest-bearing public bonds.De Vries and Van der Woude, p. 114 At first the scarcity of funds available for public borrowing was no doubt due to pessimism about the prospects of the new state. However, soon a new reason of a more propitious nature was the explosive economic boom in trade of the 1590s and early 17th century, that required financing from private capital and offered far better returns than the measly 8.33 percent (12th penny) the state could pay. This competing demand for funds can be illustrated by the fact that most people voluntarily investing in public debt up to theTwelve Years' Truce

The Twelve Years' Truce was a ceasefire during the Eighty Years' War between Spain and the Dutch Republic, agreed in Antwerp on 9 April 1609 and ended on 9 April 1621. While European powers like France began treating the Republic as a sovereign n ...

(1609) were widows and orphans. Also

the phenomenon of the emergence of a secondary market

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of the s ...

for forced loans, offered by some municipalities in Holland, which enabled merchants to free up their forced loans, and reinvest those in private ventures, points in this direction.

With the Truce more normal times arrived. The borrowing requirement went to zero with the arrival of the temporary peace and this probably helped the transition to voluntary lending. After the Truce ended in 1621 expenditures for war again rose steeply, but this time the Republic, and in particular Holland, had no trouble borrowing on average 4 million guilders annually, which helped keep down the rise in taxation that might otherwise have been necessary. By 1640 confidence in Holland's public debt (and the supply of funds available for borrowing) had risen so much, that a refinancing of the outstanding debt with a much lower interest rate of 5 percent was possible (followed in 1665 by a conversion to 4 percent).De Vries and Van der Woude, p. 115

Provincial and municipal borrowers in these days issued three types of debt instrument:

*

Provincial and municipal borrowers in these days issued three types of debt instrument:

*Promissory note

A promissory note, sometimes referred to as a note payable, is a legal instrument (more particularly, a financing instrument and a debt instrument), in which one party (the ''maker'' or ''issuer'') promises in writing to pay a determinate sum of ...

s (called ''Obligatiën''), a form of short-term debt, in the form of bearer bond

A bearer bond is a bond or debt security issued by a business entity such as a corporation or a government. As a bearer instrument, it differs from the more common types of investment securities in that it is unregistered—no records are kept o ...

s, that were readily negotiable;

* Redeemable bonds (called ''losrenten'') that paid an annual interest to the holder, whose name appeared in a public-debt ledger (not as convenient as bearer bonds, but the bonds were still readily negotiable) until the loan was paid off;

* Life annuities (called ''lijfrenten'') that paid interest during the life of the buyer, or nominee, whereas the principal is extinguished at his or her death (this type of debt was therefore self-amortizing).

Unlike other countries, where the markets for public debt were often mediated by bankers, in Holland the state dealt directly with prospective bondholders. The tax receivers doubled as registrars of the public debt. The receivers were also free to tailor bond offerings to local circumstances. They often issued many bonds of small coupon that were attractive to unsophisticated small savers, like craftsmen, and often women. This made for a kind of "popular capitalism," at least during the Golden Age of the 17th century, that often amazed foreign observers.

''Lijfrenten'' paid a higher rate of interest than ''losrenten'', which made them rather popular, the more so, because Holland at first did not make the interest dependent on the age of the nominee. It took no less an intellect than that of Grand Pensionary Johan de Witt

Johan de Witt (; 24 September 1625 – 20 August 1672), ''lord of Zuid- en Noord-Linschoten, Snelrewaard, Hekendorp en IJsselvere'', was a Dutch statesman and a major political figure in the Dutch Republic in the mid-17th century, the Fi ...

to figure out that this omission made ''lijfrenten'' too expensive. This contribution to actuarial science also helped bring down the Dutch debt service appreciably.

In practice, however, by the middle of the 17th century the Dutch Republic enjoyed such good credit, that it was able to dispense with ''lijfrenten'' and finance its borrowing requirements with long-term redeemable bonds at rates that were equal to, or lower than, the lowest interest returns available in the private sector. In fact, redemption could often be postponed indefinitely, making such loans "interest-only." This enabled the Republic in practice to spend according to its needs without practical limit, greatly exceeding its short-term ability to tax. This greatly enhanced its politico-military power, as it was able to field mercenary armies equal in size to the armies of countries with much larger populations, like France and England.

The positive side of a well-managed public debt, like the Dutch one, is that it expands the purchasing power of the state in a timely fashion, without putting undue burdens on the tax payer. However, there are prices to pay. One of those prices is an appreciable redistributive effect, when via the debt service money is channelled from a large proportion of the population (the tax payers) to a much smaller number of bondholders. In the beginning (thanks also to the forced character of the lending) this effect was limited by the broad distribution of debt-holders across the population. In the course of the 17th century, however, bondholding became more concentrated. One of the reasons for this was that new bonds were often financed by reinvesting retained interest by existing bondholders. This effect increased commensurately with the increase of the debt and the debt service. It was reinforced by the fact that bondholders were thrifty people (a tendency possibly explainable by the Ricardian equivalence

The Ricardian equivalence proposition (also known as the Ricardo–de Viti–Barro equivalence theorem) is an economic hypothesis holding that consumers are forward-looking and so internalize the government's budget constraint when making their co ...

-theorem, though people at the time were of course unaware of this theoretical underpinning).

In the course of the final third of the 17th century, and especially of the 18th century, this concentration of the public debt in the hands of a few gave rise to the emergence of a ''rentier class

Rentier capitalism describes the economic practice of gaining large profits without contributing to society. And a rentier is someone who earns income from capital without working. This is generally done through ownership of assets that generate ...

'' that amassed an important proportion of total wealth in the Republic, thanks to this redistributive effect, and despite the often confiscatory levies on wealth of the 18th century described above. This development went hand in hand with the development of the public debt itself after 1672. During the second half of the Golden Age (especially the years 1650-1665) the borrowing requirements of commerce and the public sector fell short of the amount of savings supplied by the private sector. This may explain the boom in real estate of those years, that sometimes acquired a "bubble" character. However, after the beginning of the Franco-Dutch War

The Franco-Dutch War, also known as the Dutch War (french: Guerre de Hollande; nl, Hollandse Oorlog), was fought between France and the Dutch Republic, supported by its allies the Holy Roman Empire, Spain, Brandenburg-Prussia and Denmark-Nor ...

of 1672 these savings were rechanneled to the public sector (explaining the collapse of the housing bubble at the same time). Nevertheless, the holders of this rapidly increasing public debt were still awash in cash, which explains the low interest rates in the years up to 1689. This availability of funds also helped finance the great expansion of the VOC (and of its debt) in these years.

With the great conflicts that started with the Glorious Revolution

The Glorious Revolution; gd, Rèabhlaid Ghlòrmhor; cy, Chwyldro Gogoneddus , also known as the ''Glorieuze Overtocht'' or ''Glorious Crossing'' in the Netherlands, is the sequence of events leading to the deposition of King James II and ...

of 1688 (financed with a bank loan that a consortium of Amsterdam bankers threw together in three days) these markets tightened appreciably, however. Holland was now forced to reintroduce the unprofitable ''lijfrenten'', and to resort to gimmicks like lottery bonds to entice lenders to buy its bonds. As the supply of funds from redemptions and retained earnings now fell short of government demand, these new loans must have been partially financed by disinvestment

Disinvestment refers to the use of a concerted economic boycott to pressure a government, industry, or company towards a change in policy, or in the case of governments, even regime change. The term was first used in the 1980s, most commonly in ...

s in the commercial, industrial and agricultural sectors of the economy (admittedly depressed in these years). By 1713 Holland's debt had reached a total of 310 million guilders, and that of the Generality of the Republic of 68 million (illustrating the relative preponderance of Holland in the Republic's finances). The debt service of this debt amounted to 14 million guilders. This exceeded the ordinary tax revenues of Holland. Most of this debt was now concentrated in the hands of only a relatively few families, that not so coincidentally also had privileged access to political office.

This conjuncture of factors (decision making in the hands of a political group that also owned the public debt, a debt that surmounted the ability of the economy to service it) explains in large part the "withdrawal" of the Republic as a Great Power after 1713. Once the reform proposals of Van Slingelandt, that might have provided a viable alternative by enhancing the financial capacity of the Dutch state, had been rejected by this conservative political class, there was simply no alternative to austerity in public finance, and dismantling the military power of the Republic (paying off the mercenaries and laying up the fleet). Due to adverse economic circumstances in the first decades of the 18th century even these austerity measures offered little solace in practice.

The only effect was that at least the public debt did not grow during these years, but even this trend was reversed after the forced entry into the War of the Austrian Succession caused another spike in military outlays (unfortunately with little positive effect, in view of the disastrous outcome of this war for the Republic), and therefore a spike in the growth of the debt.

The levelling-off of the growth of the debt in the years before 1740, and again after 1750, caused a curious dilemma for the Dutch ''rentiers'': they kept accumulating capital from bond redemptions and retained bond earnings, due to an undiminished high average propensity to save

In Keynesian economics, the average propensity to save (APS), also known as the savings ratio, is the proportion of income which is saved, usually expressed for household savings as a fraction of total household disposable income (taxed income). ...

(though their wealth allowed them to wallow in luxury at the same time). However, there were few attractive investment opportunities for this new capital in the domestic Dutch economy: as explained in the article on the economic history of the Netherlands, structural problems militated against expansion of the private sector, and the public debt hardly expanded (even decreased after 1750). This development gave undeniable discomfort to Dutch investors. It presented them with two unenviable alternatives: hoarding

Hoarding is a behavior where people or animals accumulate food or other items.

Animal behavior

''Hoarding'' and ''caching'' are common in many bird species as well as in rodents. Most animal caches are of food. However, some birds will a ...

(which apparently happened on an appreciable scale, leading to a large increase in the amount of money in circulation, while the velocity of circulation dropped), or investing abroad.

The ''rentiers'' therefore switched on a major scale to foreign direct investment

A foreign direct investment (FDI) is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. It is thus distinguished from a foreign portfolio investment by a notion of direct co ...

, especially in infrastructure in Great Britain (where the Industrial Revolution

The Industrial Revolution was the transition to new manufacturing processes in Great Britain, continental Europe, and the United States, that occurred during the period from around 1760 to about 1820–1840. This transition included going f ...

of that country was about to begin, preceded by an agricultural revolution that needed financing), and also in public debt in that country. The Republic in this way for the first time in history became an international capital market, especially geared to foreign sovereign debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit oc ...

in the second half of the 18th century. By 1780 the net value of Dutch foreign government lending exceeded 350 million guilders, about two-thirds of which British government debt. This brought annual foreign earnings of 16 million guilders. After 1780, other than one might expect in view of the crises following that year, this trend sharply increased. This can only be explained by wholesale disinvestment in the Dutch economy, and reinvestment in especially foreign sovereign debt. Foreign investment probably doubled to 20 million guilders annually. The result was that Dutch residents held foreign debt instruments exceeding an estimated value of a billion guilders in 1795 (though other estimates are more conservative, the lower ones are still in the 650 million range).De Vries and Van der Woude, p. 144

Banking and finance

Merchant banks and the international capital market

The remarkable growth of Dutch involvement with the international capital market, especially in the second half of the 18th century, was mediated by what we now would callmerchant bank

A merchant bank is historically a bank dealing in commercial loans and investment. In modern British usage it is the same as an investment bank. Merchant banks were the first modern banks and evolved from medieval merchants who traded in commodi ...

s. In Holland these grew out of merchant houses that shifted their capital first from financing their own trade and inventories to acceptance credit

An acceptance credit is a type of letter of credit that is paid by a time draft authorizing payment on or after a specific date, if the terms of the letter of credit have been complied with. The bank "accepts" bills of exchange drawn on the bank by ...

, and later branched out specifically into underwriting

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liabilit ...

and public offerings of foreign government bonds (denominated in Dutch guilders) in the Dutch capital markets. In this respect the domestic and foreign bond markets differed appreciably, as the Dutch government dealt directly with Dutch investors (as we have seen above).

Dutch involvement with loans to foreign governments had been as old as the Republic. At first such loans were provided by banking houses (as was usual in early-modern Europe), with the guarantee of the States General, and often also subsidized by the Dutch government. An example is the loan of 400,000 Reichstalers to

Dutch involvement with loans to foreign governments had been as old as the Republic. At first such loans were provided by banking houses (as was usual in early-modern Europe), with the guarantee of the States General, and often also subsidized by the Dutch government. An example is the loan of 400,000 Reichstalers to Gustavus Adolphus of Sweden

Gustavus Adolphus (9 December Old_Style_and_New_Style_dates">N.S_19_December.html" ;"title="Old_Style_and_New_Style_dates.html" ;"title="/nowiki>Old Style and New Style dates">N.S 19 December">Old_Style_and_New_Style_dates.html" ;"title="/now ...

around 1620 directly by the States General. When the king could not fulfill his obligations, the Amsterdam merchant Louis de Geer agreed to assume the payments in exchange for Swedish commercial concessions (iron and copper mines) to his firm. Similar arrangements between Dutch merchants and foreign governments occurred throughout the 17th century.

The transition to more modern forms of international lending came after the Glorious Revolution of 1688. The new Dutch regime in England imported Dutch innovations in public finance to England, the most important of which was the funded public debt, in which certain revenues (of the also newly introduced excises after the Dutch model) were dedicated to the amortization and service of the public debt, while the responsibility for the English debt shifted from the monarch personally, to Parliament. The management of this debt was entrusted to the innovatory Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government of ...

in 1694.This in one fell swoop put the English public debt on the same footing of creditworthiness in the eyes of Dutch investors, as the Dutch one. In the following decades wealthy Dutch investors invested directly in British government bonds, and also in British joint-stock companies like that Bank of England, and the Honourable East India Company

The East India Company (EIC) was an English, and later British, joint-stock company founded in 1600 and dissolved in 1874. It was formed to trade in the Indian Ocean region, initially with the East Indies (the Indian subcontinent and Southea ...

. This was facilitated as after 1723 such stock, and certain government bonds, were traded jointly on the London and Amsterdam Stock Exchanges.

But this applied to a safely controlled ally like England. Other foreign governments were still deemed "too risky" and their loans required the guarantee, and often subsidy, of the States General, as before (which helped to tie allies to the Dutch cause in the wars against France). After 1713 there was no longer a motivation for the Dutch government to extend such guarantees. Foreign governments therefore had to enter the market on their own. This is where the merchant banks came in, around the middle of the 18th century, with their ''emmissiebedrijf'' or public-offering business. At first, this business was limited to British and Austrian loans. The banks would float guilder-denominated bonds on behalf of those (and later other) governments, and create a market for those bonds. This was done by specialist brokers (called ''entrepreneurs'') who rounded up clients and steered them to the offerings. The banks were able to charge a hefty fee for this service.

The rapid growth of foreign investment after 1780 (as seen above) coincided with a redirection of the investment to governments other than the British. Many Dutch investors liquidated their British portfolios after the Fourth Anglo-Dutch War (which immediately resulted in a rise in British interest rates) and reinvested in French, Spanish, Polish (an especially bad choice in view of the coming Partitions of Poland

The Partitions of Poland were three partitions of the Polish–Lithuanian Commonwealth that took place toward the end of the 18th century and ended the existence of the state, resulting in the elimination of sovereign Poland and Lithuania for 12 ...

), and even American government loans. The appetite for such placements abated a little after the first defaults of foreign governments (like the French in 1793), but even under the Batavian Republic (which itself absorbed the bulk of available funds after 1795) investment in foreign funds did not fall-off completely. This may have been because Dutch investors did not always realize the riskiness of this type of investment. They were often badly served by the merchant banks, who had a vested interest in protecting their sovereign clients to the detriment of the bondholders. This is also indicated by the very slight agio of the interest rate of these risky loans over that for domestic bonds.

This apparent credulity on the part of the Dutch bondholders resulted in serious losses in the final years of the independent state, and during the annexation to France. The Dutch state for the first time in centuries defaulted after that annexation (a default that the new Kingdom of the Netherlands

, national_anthem = )

, image_map = Kingdom of the Netherlands (orthographic projection).svg

, map_width = 250px

, image_map2 = File:KonDerNed-10-10-10.png

, map_caption2 = Map of the four constituent countries shown to scale

, capital = ...

continued after the Netherlands became independent again in 1813). This ''tiercé'' (a dividing of the debt into two parts repudiated debt and one part recognized debt) followed the earlier repudiation of the French debt that had also devastated Dutch bondholders that had switched into French debt shortly before. The losses in the period 1793 to 1840 may have totalled between one-third and one half of Dutch wealth.

The ''Wisselbanken''

International payments have always posed a problem in international trade. Thoughexchange rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of ...

risks were less in the era in which the intrinsic value of money was usually equal to the face value

The face value, sometimes called nominal value, is the value of a coin, bond, stamp or paper money as printed on the coin, stamp or bill itself by the issuing authority.

The face value of coins, stamps, or bill is usually its legal value. Howe ...

(at least absent debasement

A debasement of coinage is the practice of lowering the intrinsic value of coins, especially when used in connection with commodity money, such as gold or silver coins. A coin is said to be debased if the quantity of gold, silver, copper or nick ...

of the coin, of course), there was the problem of the risk and inconvenience of transporting money or specie

Specie may refer to:

* Coins or other metal money in mass circulation

* Bullion coins

* Hard money (policy)

* Commodity money

* Specie Circular, 1836 executive order by US President Andrew Jackson regarding hard money

* Specie Payment Resumption Ac ...

. An early innovation was therefore the bill of exchange

A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, whose payer is usually named on the document. More specifically, it is a document contemplated by or consisting of a ...

(called ''wisselbrief'' in Dutch, or ''wissel'' for short), which obviated the need to transport coins in payment. After the development of this financial instrument by Italian and later Iberian merchants and bankers, Antwerp

Antwerp (; nl, Antwerpen ; french: Anvers ; es, Amberes) is the largest city in Belgium by area at and the capital of Antwerp Province in the Flemish Region. With a population of 520,504,

added a number of legal innovations in the mid-16th century that enhanced its value as such an instrument appreciably. These were assignment

Assignment, assign or The Assignment may refer to:

* Homework

* Sex assignment

* The process of sending National Basketball Association players to its development league; see

Computing

* Assignment (computer science), a type of modification to ...

, endorsement, and discounting

Discounting is a financial mechanism in which a debtor obtains the right to delay payments to a creditor, for a defined period of time, in exchange for a charge or fee.See "Time Value", "Discount", "Discount Yield", "Compound Interest", "Efficient ...

of bills of exchange. The ''Antwerpse Costuymen'' (commercial laws of Antwerp), which were adapted in Amsterdam from 1597, allowed unlimited chains of endorsement. This may have been convenient, but it increased the risk of default with each additional endsorsement in the chain. For that reason the Amsterdam city government prohibited this practice.

Instead, in 1609 a new municipal institution was established (after the example of the Venetian '' Banco della Piassa di Rialto'', established in 1587) in the form of the

Instead, in 1609 a new municipal institution was established (after the example of the Venetian '' Banco della Piassa di Rialto'', established in 1587) in the form of the Amsterdamsche Wisselbank

The Bank of Amsterdam ( nl, Amsterdamsche Wisselbank, lit=Exchange Bank of Amsterdam) was an early bank, vouched for by the city of Amsterdam, and established in 1609. It was the first public bank to offer accounts not directly convertible to co ...

, also called the Bank of Amsterdam. This bank (with offices in the City Hall) took deposits of foreign and domestic coin (and after 1683 specie), effected transfers between such deposit accounts (the giro function), and accepted (i.e. paid) bills of exchange (the more important of which - over 600 guilders in value - could now be endorsed - to the bank - only once). The latter provision effectively forced Amsterdam merchants (and many foreign merchants) to open accounts with this bank. Though Amsterdam established the first such bank in Holland, other cities, like Delft

Delft () is a List of cities in the Netherlands by province, city and Municipalities of the Netherlands, municipality in the Provinces of the Netherlands, province of South Holland, Netherlands. It is located between Rotterdam, to the southeast, ...

, Middelburg Middelburg may refer to:

Places and jurisdictions Europe

* Middelburg, Zeeland, the capital city of the province of Zeeland, southwestern Netherlands

** Roman Catholic Diocese of Middelburg, a former Catholic diocese with its see in the Zeeland ...

, and Rotterdam

Rotterdam ( , , , lit. ''The Dam on the River Rotte'') is the second largest city and municipality in the Netherlands. It is in the province of South Holland, part of the North Sea mouth of the Rhine–Meuse–Scheldt delta, via the ''"N ...

, followed in due course. The Amsterdam establishment was, however, the most important and the best known.

The giro function had the additional advantage (beside the obvious convenience) that the value of the underlying deposit was guaranteed. This was important in an era in which Metallism

Metallism is the economic principle that the value of money derives from the purchasing power of the commodity upon which it is based. The currency in a metallist monetary system may be made from the commodity itself (commodity money) or it may us ...

still reigned supreme. As a matter of fact, depositors were prepared to pay a small "fee" in the form of an agio for this "bank money" or ''bankgeld'' (which was an early example of fiat money

Fiat money (from la, fiat, "let it be done") is a type of currency that is not backed by any commodity such as gold or silver. It is typically designated by the issuing government to be legal tender. Throughout history, fiat money was sometime ...

) over normal circulating coin, called ''courantgeld''. Though the ''wisselbank'' was not a mint

MiNT is Now TOS (MiNT) is a free software alternative operating system kernel for the Atari ST system and its successors. It is a multi-tasking alternative to TOS and MagiC. Together with the free system components fVDI device drivers, XaA ...

, it provided coins deposited with it for melting and recoining at Dutch mints in the form of a high-quality currency, called "trade money" (or ''negotiepenningen'' in Dutch). These coins were used in trade with areas where the Dutch and other West Europeans had a structural trade deficit

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balance ...

, like the Far East, Russia and the Levant

The Levant () is an approximate historical geographical term referring to a large area in the Eastern Mediterranean region of Western Asia. In its narrowest sense, which is in use today in archaeology and other cultural contexts, it is eq ...

, because they were highly valued there for their quality as commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves (intrinsic value) as well as their value in buying goods.

This is in contrast to representati ...

.

These trade coins were distinguished from the circulating currency (Dutch: ''standpenningen'') that after the reform of the currency of 1622, that allowed the minting of coins with a lower-than-face-value metal content, had the character of fiat money. This development recognized the reality that most money in circulation had a fiduciary character. Toward the end of the 17th century the Republic became (thanks to its general balance-of-trade surplus, and the policy of the ''Wisselbank'') a reservoir of coin and bullion

Bullion is non-ferrous metal that has been refined to a high standard of elemental purity. The term is ordinarily applied to bulk metal used in the production of coins and especially to precious metals such as gold and silver. It comes from t ...

, which was regularly (re-)minted as trade coin, thereby "upgrading" inferior circulating money.

Unlike the later Bank of England, the Bank of Amsterdam did not act as a lender of last resort

A lender of last resort (LOLR) is the institution in a financial system that acts as the provider of liquidity to a financial institution which finds itself unable to obtain sufficient liquidity in the interbank lending market when other facil ...

. That function was, however, performed by other institutions in the course of the history of the Republic, be it on a rather ad hoc basis: during financial crises in the second half of the 18th century lenders of last resort were briefly brought into being, but liquidated soon after the crisis had abated.De Vries and Van der Woude, p. 155 The function of bank of issue

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central ba ...

was often performed by small private operations, called ''kassiers'' (literally: "cashiers") that accepted ''courantgeld'' for deposit, and issued promissory notes for domestic payments. These notes functioned as an early type of paper money. The same went after 1683 for the Bank of Amsterdam when its receipts for foreign coin and bullion were accepted as fiduciary money.

Those ''kassiers'' engaged also in fractional-reserve banking

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve, ...

, as did the other ''wisselbanken'' outside Amsterdam, though this "risky" practice was officially frowned upon. During the crisis of 1672 the Middelburg ''wisselbank'', that had actively lent deposited funds to local businessmen, faced a bank run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

which forced it to suspend payments for a while. The Amsterdam ''wisselbank'', at least at first, officially did not engage in this practice. In reality it did lend money to the city government of Amsterdam and to the East-India Company, both solid credit risks at the time, though this was technically in violation of the bank's charter. The loophole was that both debtors used a kind of anticipatory note, so that the loans were viewed as advances of money. This usually did not present a problem, except when during the Fourth Anglo-Dutch War the anticipated income did not materialize, causing a liquidity crisis for both the bank and its debtors.

Another important business for Dutch bankers was foreign exchange trading

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all asp ...

. The bills of exchange originated in many countries and specified settlement in many different foreign currencies. Theoretically the exchange rates of these currencies were fixed by their intrinsic values, but (just as in modern times) trade fluctuations could cause the market exchange rate to diverge from this intrinsic rate. This risk was minimized, however, at Amsterdam, because the freedom there to export and import monetary metals tended to stabilize the exchange rates. Besides, Dutch merchants traded all over the known world and generated bills of exchange all over. This helped to generate regular exchange-rate quotations (an important information function) with many foreign locations. For these reasons Amsterdam attracted a business in bills of exchange that went far beyond the needs of its own already appreciable business. Merchants from many Mediterranean countries (where exchange rates with northern currencies were seldom quoted) bought bills on Amsterdam, where other bills on the intended final destinations could be acquired. Even London merchants long relied on the Amsterdam money market, especially for the English trade on Russia, at least till 1763.De Vries and Van der Woude, p. 136

In sum, most "modern" banking practices were already present in the Republic, and often exported abroad (like the fractional banking practices of the predecessor of the Swedish Riksbanken, the Stockholms Banco

Stockholms Banco (also known as the Palmstruch's Bank, sv, Palmstruchska banken) was the first European bank to print banknotes. It was founded in 1657 by Johan Palmstruch in Stockholm, began printing banknotes in 1661, but ran into financial di ...

, founded by Dutch financier Johan Palmstruch

Johan Palmstruch (June 13, 1611 – March 8, 1671) was a Latvian-born German/Dutch/Swedish entrepreneur, financier, and financial innovator. He is credited with the introduction of paper money to Europe.

Biography

Johan (Hans) Wittmacher was b ...

; and later the Bank of England). They were, however, often not institutionalized on a "national" level, due to the stubbornly confederal nature of the Republic. For this reason the Netherlands only in 1814 got a formal central bank.

Commercial credit and insurance

As explained in the general article on the economic history of the Netherlands under the Republic, the Dutchentrepôt

An ''entrepôt'' (; ) or transshipment port is a port, city, or trading post where merchandise may be imported, stored, or traded, usually to be exported again. Such cities often sprang up and such ports and trading posts often developed into co ...

function was very important. One of the reasons Amsterdam was able to win this function after the Fall of Antwerp

The Fall of Antwerp on 17 August 1585 took place during the Eighty Years' War, after a siege lasting over a year from July 1584 until August 1585. The city of Antwerp was the focal point of the Protestant-dominated Dutch Revolt, but was force ...

was the commercial credit offered to suppliers and buyers, usually as part of the discount on the bill of exchange. By prolonging and rolling-over such short-term credits, suppliers and customers could easily be tied to the entrepôt. The low interest rates usually prevailing in the Republic made the maintenance of large inventories feasible, thereby enhancing Amsterdam's reputation as the world's Emporium.

Though this commercial credit was originally tied to the trading operation of merchant firms, the sheer scope of the entrepôt created the opportunity for the trading in bills apart from this direct business, thereby serving third parties, even those not doing direct business with the Netherlands. Two kinds of financial trading, divorced from commercial trading, began to emerge by the beginning of the 18th century: trading on commission, and accepting house

An accepting house was a primarily British institution which specialised in the acceptance and guarantee of bills of exchange thereby facilitating the lending of money. They took on other functions as the use of bills declined, returning to thei ...

s. The first consisted of trading of agents (called ''commissionairs'') on behalf of other merchants for a commission. Their role was therefore intermediation between buyers and sellers, leaving the conclusion of the business to those parties themselves.

The second consisted in guaranteeing payment on bills of exchange from third parties. If the third party issuing the bill would default, the accepting house would pay the bill itself. This guarantee of course was provided for a fee. This service need not have any connection with Dutch traders, or even with the Dutch entrepôt. It served international trade in general. Though this divorce between credit provision and trade has been interpreted as undermining Dutch trade itself in the age of relative decline of Dutch commerce, it probably was just a defensive move in a time of increasing foreign competition, protecting a share for Dutch commerce, and providing another outlet for commercial capital that would otherwise have been idle. The size of this business was estimated to be about 200 million guilders around 1773.

Much lending and borrowing of course occurred outside the formal economy. Unfortunately, it is difficult to document the size of this informal business. However, the archived registers of the notaries

A notary is a person authorised to perform acts in legal affairs, in particular witnessing signatures on documents. The form that the notarial profession takes varies with local legal systems.

A notary, while a legal professional, is disti ...